Do you dream of changing your life, leaving the city for the countryside and starting an exciting professional project in contact with people? The rural tourist real estate market in France offers exceptional opportunities. Whether you are looking for a career change or a profitable real estate investment, ma-propriete.fr supports you in your approach. Are you considering selling your property? Discover our solutions for selling your tourist property under the best conditions. To make a successful purchase, we recommend that you consult our dedicated buying guides.

France remains the world’s leading tourist destination, and rural tourism, or “green tourism”, is experiencing unprecedented growth. Holidaymakers are increasingly looking for authenticity, peace and heritage. It is in this favourable context that the purchase of a tourist property takes place.

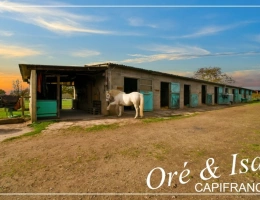

On our portal, you will discover a wide variety of properties. It is not simply a matter of buying a house, but of acquiring an efficient working tool. These properties often stand out for their charm and character. You can find a sun-drenched Provençal farmhouse, a typical longère in Brittany or Normandy, a renovated farmstead with exposed stonework, or even a majestic manor house nestled in a green setting. For lovers of history and originality, a mill by the water, a bastide in the South-West, a historic residence or a former coaching inn provide idyllic settings to attract a demanding clientele.

To succeed in this commercial activity, infrastructure is essential. The properties presented generally offer an accommodation capacity suited to your project, whether it involves intimate bed and breakfast rooms or gîtes for families and groups. The interiors often feature comfortable master suites and en-suite bathrooms, which are essential to guarantee visitor comfort. High-quality renovation is a major asset for starting out without heavy work.

Outside, the environment plays a key role in the attractiveness of the offer. A wooded park for strolling, a heated swimming pool for summer relaxation, or converted outbuildings significantly increase the value of the business. More and more owners are developing a wellness area (spa, sauna) or a reception room for weddings and seminars, thus diversifying their income. Finally, it is essential to preserve your privacy; this is why the presence of staff accommodation or independent apartments for the owners is a frequent search criterion.

Geographically, these opportunities are found throughout France, but some departments stand out thanks to their highly sought-after locations and their proximity to major tourist sites (Châteaux of the Loire, Dordogne, Provence, Côte d’Azur, etc.).

Purchasing a tourist property is both a real estate and entrepreneurial project. The first financial criterion concerns the purchase of the walls and business. Indeed, in the context of a business takeover, you are buying not only the buildings, but also the clientele and the reputation of the establishment. It is therefore crucial to analyse the existing turnover and the current rental yield. A loyal customer base is a valuable asset that allows you to generate income from day one, notably thanks to the breakfast service included in bed and breakfasts or through seasonal accommodation rentals.

If you are looking for development potential, check whether the property allows you to diversify the offer. For example, creating a table d’hôtes can increase the average basket per customer, but it requires specific organisation and culinary skills. If you wish to serve alcohol with meals, obtaining or transferring a licence IV will be necessary.

Financing this type of project differs from a traditional mortgage. Banks will require a solid business plan, especially if the loan repayment is based on income from the tourist activity. It is often recommended to have a substantial personal contribution (generally between 30% and 50% of the total amount).

Do not forget the regulatory aspects: accessibility standards (ERP), planning regulations for fitting out converted outbuildings or installing light structures in the park.

Ma-propriete.fr is designed to simplify your search and help you find that rare gem. Our advanced search engine allows you to filter listings according to specific criteria:

To make sure you don’t miss any opportunities, we suggest you create email alerts. As soon as a new listing matching your criteria (such as a renovated farmstead in Dordogne or a Provençal farmhouse with a heated swimming pool) is published, you are notified instantly.

Our platform brings together listings from real estate professionals (estate agents, notaries) and private individuals. You benefit from direct contact with the seller via our secure form, without any opaque intermediary. In addition, the geolocation of listings (when authorised by the seller) allows you to view the property’s immediate environment, its proximity to tourist sites and transport links.

Selling a tourist property requires expertise and targeted visibility that generalist listing sites cannot offer. Ma-propriete.fr ensures optimum visibility to a qualified audience specifically looking for rural and tourist properties.

The advantages for sellers are numerous:

The ad submission interface is easy to use, allowing you to showcase your assets: photos of your wooded park, wellness area, description of the high-quality renovation, etc.

Beyond simply publishing listings, ma-propriete.fr positions itself as a real partner for your rural project.

Whether you want to sell a property full of charm and character or buy the walls and business to launch your gîte activity, ma-propriete.fr is the essential hub for bringing your ambitions in rural tourism to life.